What is a K-1 Trust Distribution? - CPA Firm, Accounting & Taxes

Por um escritor misterioso

Last updated 20 setembro 2024

:max_bytes(150000):strip_icc()/Form1065-55a61388dd91421d8736a94d3b20f03e.jpg)

Form 1065: U.S. Return of Partnership Income: Definition and How to File

Are Trust Distributions Taxable? Trust Distribution Taxes Explained - Keystone Law

Are Trust Distributions Taxable? Trust Distribution Taxes Explained - Keystone Law

Estates, Trusts & Gift Taxes Flashcards

On form 1041, beneficiaries get divs & int on form K-1. Yet, the TT business wrongly adds that income to the trust. How is div/int excluded from trust income?

:max_bytes(150000):strip_icc()/Form1041-36b8feef0014418ab6aa150c951c7609.png)

What Is IRS Form 1041?

Income Tax Accounting for Trusts and Estates

How Long Does a Trustee Have to Distribute Assets?

How to Read and Love a K-1 Tax Form - Actively Passive

Why is the Income on My K-1 Different from the Cash I Received? - Schanel & Associates CPA

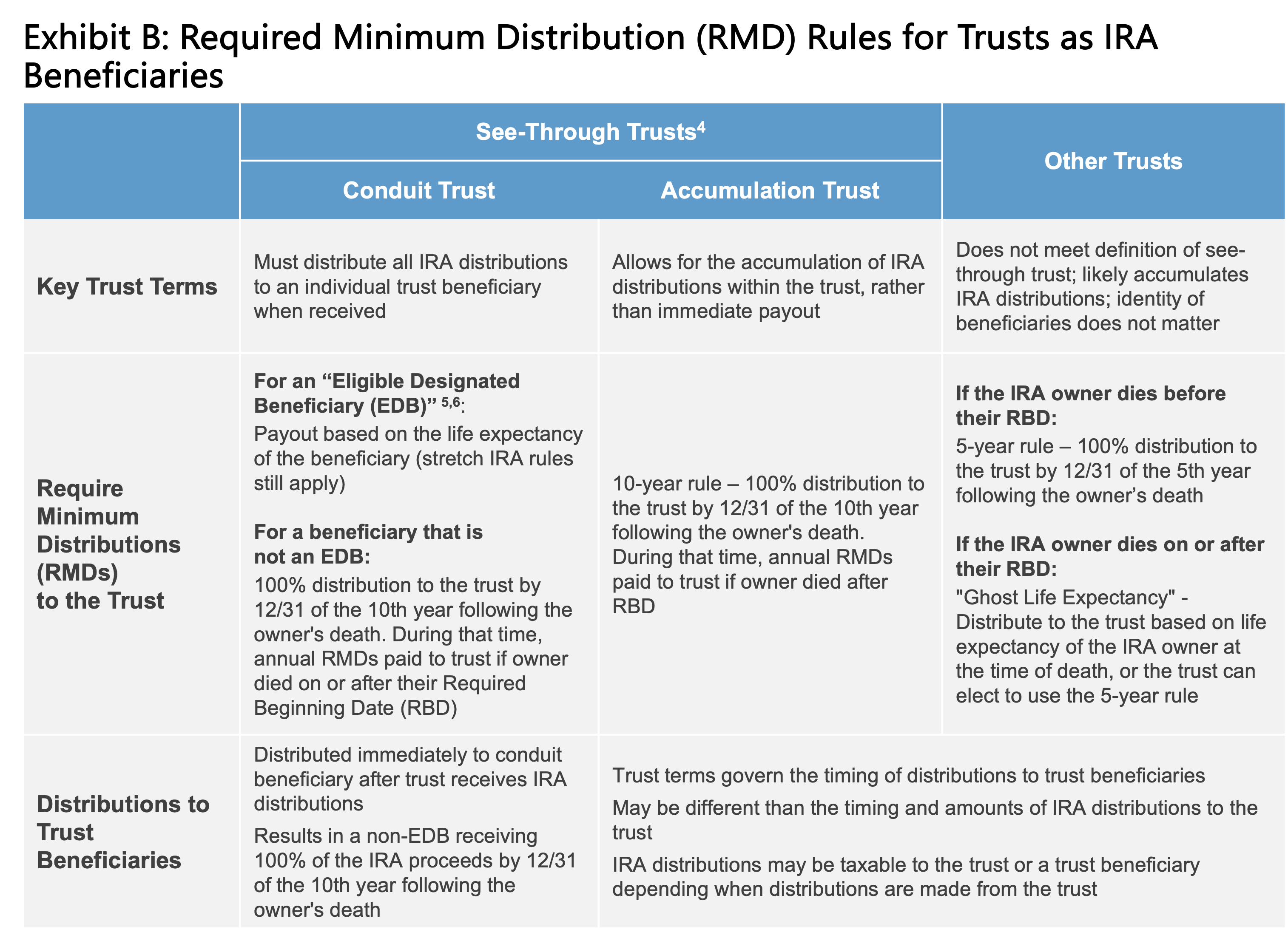

Naming a Trust as IRA Beneficiary: Key Considerations - Fiduciary Trust

Recomendado para você

-

Congruent Triangles: S-S-S, S-A-S, A-S-A, A-A-S - Janet Gantert20 setembro 2024

Congruent Triangles: S-S-S, S-A-S, A-S-A, A-A-S - Janet Gantert20 setembro 2024 -

Rappler on X: All Social Security System (SSS) branches are open20 setembro 2024

Rappler on X: All Social Security System (SSS) branches are open20 setembro 2024 -

Pole-Zero Representations of Linear Physical Systems20 setembro 2024

Pole-Zero Representations of Linear Physical Systems20 setembro 2024 -

IXL - SSS, SAS, ASA, and AAS Theorems (Geometry practice)20 setembro 2024

IXL - SSS, SAS, ASA, and AAS Theorems (Geometry practice)20 setembro 2024 -

File:Nissan Bluebird (U13) SSS rear.jpg - Wikimedia Commons20 setembro 2024

File:Nissan Bluebird (U13) SSS rear.jpg - Wikimedia Commons20 setembro 2024 -

Atividades letra S Archives - Espaço do Professor20 setembro 2024

Atividades letra S Archives - Espaço do Professor20 setembro 2024 -

Refurbished Apple Watch SE (2nd Generation) GPS, 40mm Starlight20 setembro 2024

-

S Club 7 to continue tour following death of Paul Cattermole and20 setembro 2024

S Club 7 to continue tour following death of Paul Cattermole and20 setembro 2024 -

45mm Light Pink Sport Band - S/M - Apple20 setembro 2024

-

Use Snipping Tool to capture screenshots - Microsoft Support20 setembro 2024

Use Snipping Tool to capture screenshots - Microsoft Support20 setembro 2024

você pode gostar

-

COMO COLOCAR LETRA DIFERENTE NO NOME DO FREE FIRE COMO FAZER NICK PERSONALIZADO NO FREE FIRE EM 202220 setembro 2024

COMO COLOCAR LETRA DIFERENTE NO NOME DO FREE FIRE COMO FAZER NICK PERSONALIZADO NO FREE FIRE EM 202220 setembro 2024 -

File:Bedrock-0.7.27-poki-01.08.22.png - Wikimedia Commons20 setembro 2024

File:Bedrock-0.7.27-poki-01.08.22.png - Wikimedia Commons20 setembro 2024 -

Last of Us (V4) - Sony PlayStation 3 PS3 - Empty Custom20 setembro 2024

Last of Us (V4) - Sony PlayStation 3 PS3 - Empty Custom20 setembro 2024 -

) Now, Facebook will let Indians catch NBA's regular-season live for20 setembro 2024

Now, Facebook will let Indians catch NBA's regular-season live for20 setembro 2024 -

Gotham Knights: veja requisitos mínimos para rodar o jogo no PC20 setembro 2024

Gotham Knights: veja requisitos mínimos para rodar o jogo no PC20 setembro 2024 -

tr.rbxcdn.com/9b572a9ba140abaa1445428ed1308324/76820 setembro 2024

-

61 Brilliant Stranger Things” Memes That Will Take Your Mood From20 setembro 2024

61 Brilliant Stranger Things” Memes That Will Take Your Mood From20 setembro 2024 -

Galactic Gun, Trade Roblox Murder Mystery 2 (MM2) Items20 setembro 2024

Galactic Gun, Trade Roblox Murder Mystery 2 (MM2) Items20 setembro 2024 -

Estados Unidos da América bandeira e casaco uniforme militar20 setembro 2024

Estados Unidos da América bandeira e casaco uniforme militar20 setembro 2024 -

Logo Quiz: Guess the logos on the App Store20 setembro 2024

Logo Quiz: Guess the logos on the App Store20 setembro 2024